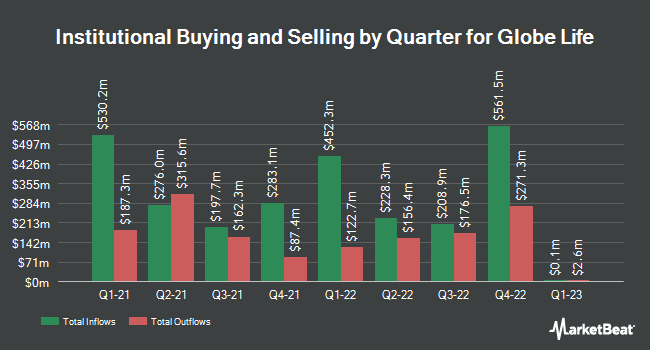

National Bank of Canada FI increased its position in Globe Life Inc. (NYSE: GL – Get Rating) by 4,445.5% in the 4th quarter, according to the company in its latest Form 13F filed with the Securities and Exchange Commission ( DRY). The fund held 25,455 shares of the company after purchasing an additional 24,895 shares during the period. National Bank of Canada IF’s holdings in Globe Life were worth $3,069,000 at the end of the most recent reporting period.

→ Stocks are for suckers – try this instead (From Legacy Research)

Other major investors have also recently changed their positions in the company. OLD National Bancorp IN increased its stake in Globe Life by 4.7% in the third quarter. OLD National Bancorp IN now owns 6,152 shares of the company valued at $613,000 after buying an additional 278 shares in the last quarter. Metis Global Partners LLC purchased a new stake in shares of Globe Life during the third quarter valued at approximately $205,000. Maryland State Retirement & Pension System purchased a new stake in Globe Life during the fourth quarter valued at $840,000. Guggenheim Capital LLC increased its position in Globe Life by 5.7% in the third quarter. Guggenheim Capital LLC now owns 16,174 shares of the company worth $1,613,000 after purchasing an additional 869 shares in the last quarter. Finally, Robeco Institutional Asset Management BV increased its stake in Globe Life by 4.6% in the third quarter. Robeco Institutional Asset Management BV now owns 255,285 shares of the company valued at US$25,453,000 after purchasing an additional 11,275 shares during the period. 81.04% of the shares are held by institutional investors.

Insider Activity at Globe Life

In other Globe Life news, Executive Vice President Robert Brian Mitchell sold 38,000 shares of the company in a trade dated Monday, February 27. The stock was sold at an average price of $121.45, for a total value of $4,615,100.00. Following the transaction, the executive vice president now directly owns 4,310 shares of the company, valued at approximately $523,449.50. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available via this hyperlink. Separately, insider Steven John Dichiaro sold 5,000 shares of the company in a trade on Wednesday, February 8. The shares were sold at an average price of $121.64, for a total value of $608,200.00. Following the completion of the transaction, the insider now directly owns 8,372 shares of the company, valued at $1,018,370.08. The sale was disclosed in a document filed with the Securities & Exchange Commission, accessible via this hyperlink. Additionally, Executive Vice President Robert Brian Mitchell sold 38,000 shares in a trade on Monday, February 27. The shares were sold at an average price of $121.45, for a total value of $4,615,100.00. Following the completion of the transaction, the executive vice president now directly owns 4,310 shares of the company, valued at approximately $523,449.50. The disclosure of this sale can be found here. During the last quarter, insiders sold 96,125 shares of the company worth $11,603,160. Insiders of the company own 4.33% of the shares of the company.

Performance of Globe Life shares

NYSE: GL opened at $107.74 on Friday. The company’s 50-day moving average is $115.57 and its 200-day moving average is $114.89. The company has a market capitalization of $10.40 billion, a price-earnings ratio of 14.42 and a beta of 0.79. The company has a debt ratio of 0.33, a quick ratio of 0.05 and a current ratio of 0.05. Globe Life Inc. has a 52-week low of $87.87 and a 52-week high of $123.85.

Globe Life (NYSE:GL – Get Rating) last announced its quarterly results on Wednesday, February 1. The company reported earnings per share (EPS) of $2.24 for the quarter, beating analyst consensus estimates of $2.17 by $0.07. The company posted revenue of $1.32 billion for the quarter, versus a consensus estimate of $1.33 billion. Globe Life had a net margin of 14.18% and a return on equity of 15.03%. The company’s revenue for the quarter increased 2.0% year over year. In the same period a year earlier, the company posted earnings per share of $1.70. Research analysts predict Globe Life Inc. will post EPS of 10.35 for the current year.

Globe Life increases its dividend

The company also recently disclosed a quarterly dividend, which will be paid on Monday, May 1. Investors of record on Monday, April 3 will receive a dividend of $0.225. This represents a dividend of $0.90 on an annualized basis and a dividend yield of 0.84%. The ex-dividend date is Friday, March 31. This is an increase from Globe Life’s previous quarterly dividend of $0.21. Globe Life’s dividend payout ratio (DPR) is 12.05%.

Changes to analyst ratings

GL has been the subject of a number of research analyst reports. JPMorgan Chase & Co. raised its price target on Globe Life shares from $112.00 to $126.00 and gave the stock an “overweight” rating in a Friday, Jan. 6, report. Raymond James cut his price target on Globe Life shares from $141.00 to $138.00 and set a “Strong Buy” rating for the company in a Tuesday, March 14 research report. Truist Financial raised its price target on Globe Life shares from $112.00 to $125.00 and gave the stock a “holding” rating in a Friday, Feb. 3 report. StockNews.com downgraded Globe Life from a “buy” rating to a “hold” rating in a Wednesday, March 15 report. Finally, Credit Suisse Group raised its price target on Globe Life from $130.00 to $140.00 and gave the company an “outperform” rating in a Monday, Dec. 19 research note. One analyst gave the stock a sell rating, two gave the stock a hold rating, four gave the stock a buy rating and one gave the stock a strong buy rating. According to data from MarketBeat.com, the company has an average rating of “Moderate Buy” and an average price target of $129.14.

Profile of Globe Life

(Get a rating)

Globe Life, Inc. is a holding company that provides individual life and supplemental health insurance products and services. It operates through the following segments: life insurance, supplementary health insurance, annuities and investments. The life insurance segment includes traditional and interest rate sensitive whole life insurance as well as term life insurance.

See also

Want to see which other hedge funds hold GL? Visit HoldingsChannel.com for the latest 13F filings and insider trading for Globe Life Inc. (NYSE:GL – Get Rating).

This instant news alert was powered by MarketBeat’s storytelling science technology and financial data to provide readers with the fastest and most accurate reports. This story was reviewed by MarketBeat’s editorial team prior to publication. Please send questions or comments about this story to contact@marketbeat.com.

Before you consider Globe Life, you’ll want to hear this.

MarketBeat tracks Wall Street’s top-rated, top-performing research analysts daily and the stocks they recommend to their clients. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the market takes off…and Globe Life wasn’t on the list.

While Globe Life currently has a “moderate buy” rating among analysts, top-rated analysts believe these five stocks are better buys.

See the five actions here

Elon Musk’s next move

Wondering when you can finally invest in SpaceX, StarLink or The Boring Company? Click the link below to find out when Elon Musk will finally let these companies go public.

Get this free report