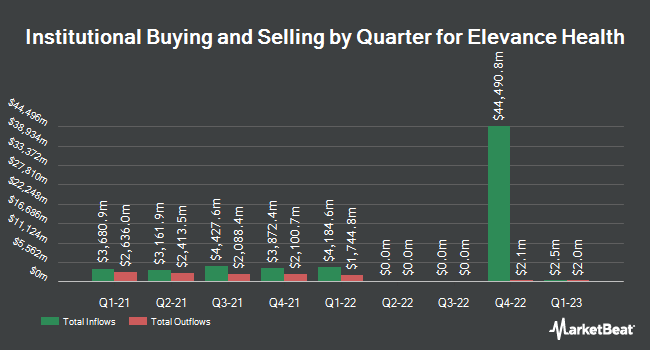

Strategic Blueprint LLC acquired a new stake in Elevance Health, Inc. (NYSE: ELV – Get Rating) during the 4th quarter, according to its latest 13F filing with the Securities and Exchange Commission (SEC). The institutional investor acquired 800 shares of the company, valued at approximately $411,000.

Strategic Blueprint LLC acquired a new stake in Elevance Health, Inc. (NYSE: ELV – Get Rating) during the 4th quarter, according to its latest 13F filing with the Securities and Exchange Commission (SEC). The institutional investor acquired 800 shares of the company, valued at approximately $411,000.

→ “Prepare for five years of famine” (From Legacy Research)

Other major investors have also changed their positions in the company. Baillie Gifford & Co. acquired a new position in Elevance Health in Q4 worth approximately $1,936,996,000. Charles Schwab Investment Management Inc. raised its position in Elevance Health shares by 3.0% in the first quarter. Charles Schwab Investment Management Inc. now owns 1,333,044 shares of the company valued at $654,818,000 after buying 38,563 additional shares in the last quarter. Arrowstreet Capital Limited Partnership increased its stake in shares of Elevance Health by 825.5% during the first quarter. Arrowstreet Capital Limited Partnership now owns 758,754 shares of the company valued at $372,715,000 after purchasing an additional 676,769 shares during the period. Focused Investors LLC acquired a new stake in Elevance Health during the fourth quarter valued at approximately $254,151,000. Finally, First Trust Advisors LP increased its position in Elevance Health by 16.5% during the first quarter. First Trust Advisors LP now owns 473,269 shares of the company worth $232,479,000 after acquiring an additional 66,880 shares in the last quarter. Institutional investors and hedge funds hold 87.66% of the company’s shares.

Insider Trading at Elevance Health

Separately, Executive Vice President Gloria M. McCarthy sold 15,098 shares of the company in a trade on Friday, March 24. The stock was sold at an average price of $444.76, for a total transaction of $6,714,986.48. Following the transaction, the executive vice president now directly owns 51,435 shares of the company, valued at $22,876,230.60. The sale was disclosed in a filing with the Securities & Exchange Commission, available on the SEC’s website. Insiders own 0.27% of the shares of the company.

Elevance Health Stock down 0.2%

ELV stock opened at $483.54 on Friday. The company has a current ratio of 1.40, a quick ratio of 1.40 and a debt ratio of 0.61. The company has a 50-day simple moving average of $474.54 and a 200-day simple moving average of $489.86. The company has a market capitalization of $114.73 billion, a P/E ratio of 19.51, a PEG ratio of 1.22 and a beta of 0.84. Elevance Health, Inc. has a 12-month low of $440.02 and a 12-month high of $549.52.

Elevance Health (NYSE:ELV – Get Rating) last reported quarterly earnings data on Wednesday, January 25. The company reported earnings per share of $5.23 for the quarter, beating the consensus estimate of $5.20 by $0.03. The company posted revenue of $39.67 billion in the quarter, versus analyst estimates of $39.62 billion. Elevance Health had a net margin of 3.85% and a return on equity of 19.56%. The company’s revenue for the quarter increased by 10.1% compared to the same quarter last year. During the same period last year, the company achieved EPS of $5.14. On average, stock research analysts expect Elevance Health, Inc. to post 32.72 earnings per share for the current fiscal year.

Elevance Health increases dividend

The company also recently announced a quarterly dividend, which was paid on Friday, March 24. Shareholders of record on Friday, March 10 received a dividend of $1.48 per share. This represents a dividend of $5.92 on an annualized basis and a yield of 1.22%. The ex-dividend date was Thursday, March 9. This is an increase from Elevance Health’s previous quarterly dividend of $1.28. Elevance Health’s dividend payout ratio (DPR) is currently 23.88%.

Changes to analyst ratings

ELV has been the subject of a number of recent analyst reports. Deutsche Bank Aktiengesellschaft lowered its price target on Elevance Health from $581.00 to $571.00 and set a “buy” rating for the company in a Wednesday, March 8 research report. Royal Bank of Canada has upgraded Elevance Health from an ‘sector performer’ rating to an ‘outperformer’ rating and raised its price target for the company from $523.00 to $572.00 in a report Tuesday, March 28. JPMorgan Chase & Co. raised its price target on Elevance Health shares from $555.00 to $572.00 and gave the stock an “overweight” rating in a Thursday, Feb. 23 report. StockNews.com began covering Elevance Health stocks in a research report on Thursday, March 16. They issued a “Strong Buy” rating on the stock. Finally, Truist Financial lowered its price target on Elevance Health shares from $610.00 to $580.00 and set a “buy” rating for the company in a research report on Friday, March 24. Two analysts gave the stock a hold rating, twelve gave the company a buy rating and one gave the company’s stock a strong buy rating. According to MarketBeat, the company currently has a consensus rating of “Moderate Buy” and a consensus target price of $584.26.

Elevance Health Company Profile

(Get a rating)

Elevance Health, Inc operates as a healthcare company committed to improving lives and communities and simplifying healthcare. It operates through the following segments: Commercial and Specialty Enterprises, Government Enterprises, CarelonRx and Others. The Commercial and Specialty Businesses segment provides insurance products and services, such as stop loss insurance, dental insurance, vision insurance, life, disability and supplemental health insurance.

See also

Want to see which other hedge funds hold ELV? Visit HoldingsChannel.com for the latest 13F filings and insider trading for Elevance Health, Inc. (NYSE:ELV – Get Rating).

This instant news alert was powered by MarketBeat’s storytelling science technology and financial data to provide readers with the fastest and most accurate reports. This story was reviewed by MarketBeat’s editorial team prior to publication. Please send questions or comments about this story to contact@marketbeat.com.

Before you consider Elevance Health, you’ll want to hear this.

MarketBeat tracks Wall Street’s top-rated, top-performing research analysts daily and the stocks they recommend to their clients. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the market takes off…and Elevance Health wasn’t on the list.

Although Elevance Health currently has a “Moderate Buy” rating among analysts, top-rated analysts believe these five stocks are better buys.

See the five actions here